HaiKhuu Daily Report - 01/30/2026

Good morning, and happy Friday!

Man oh man, this has been a volatile week for the markets, and I hope you all are ready for what the markets will have in store for us today! With the confusion being experienced across the board, traders are experiencing elevated volatility and watching as everyone is realizing a significant amount of gains and losses in an extremely short period of time.

I hope you all have been making the most out of these conditions, because it’s been irrational, and the opportunities have been presented to us.

Markets are down slightly at the time of writing this report, and sentiment is mildly strong as a result of confusing $AAPL sentiment. iPhone sales dropped heavily, but sales increased by 16%, resulting in a slight movement up in the markets. So, I hope you all are prepared for the final day of volatility this week. Conditions will be confusing, but we will have an absolutely amazing time.

Just end this week strong, realize some gains, and have some fun while the markets are volatile.

Let’s make the most out of all of the opportunities presented to us today and have some fun!

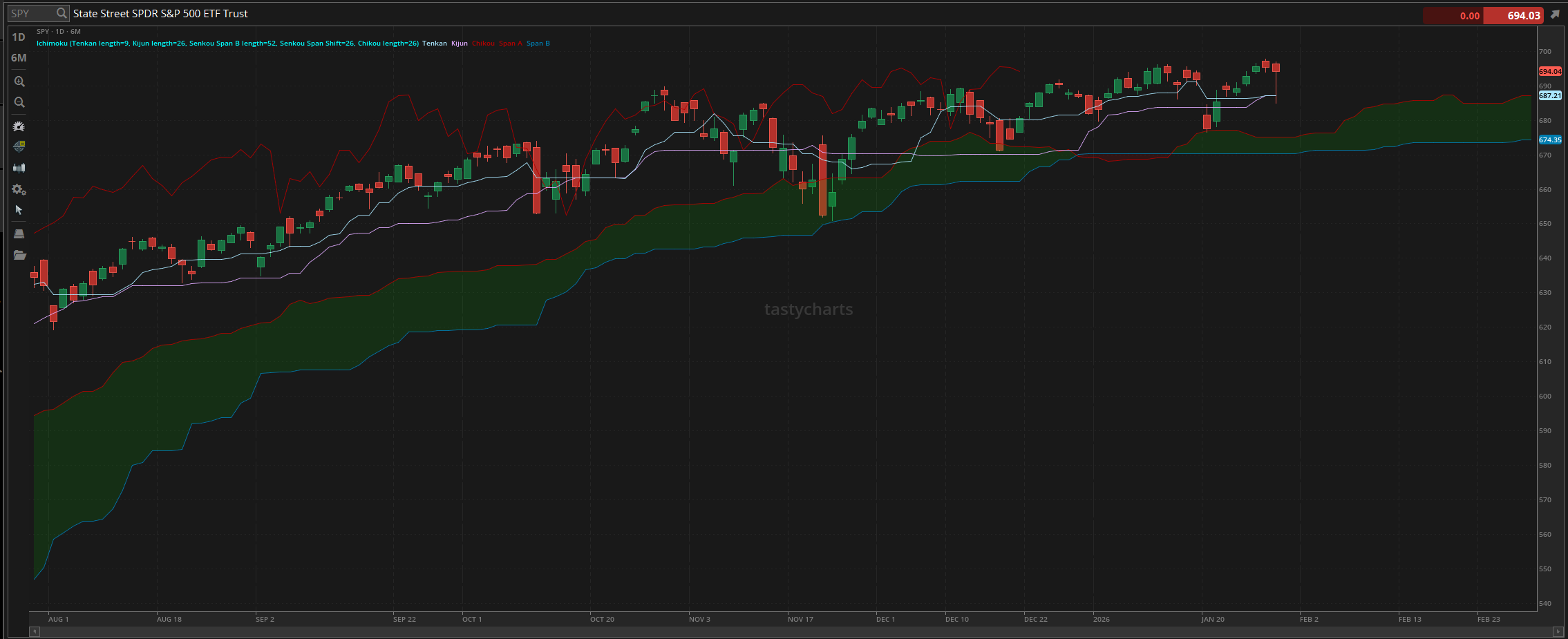

The updated $SPY daily levels are as follows:

Conversion Line Support: $687.21

Baseline Support: $687.21

Psychological Support: $680

Psychological Resistance: $700

Previous All-Time High: $697.84

Daily Cloud Support: $670.16

Thoughts & Comments from Yesterday - 01/29/2026

Yesterday was an absolutely DEADLY trading day for many individuals, but opportunities were consistently presented to us to trade both directions. Both the bulls and the bears could have printed yesterday, but it all came down to how you allocated, when you allocated, and where you attempted to allocate. Those who simply followed the momentum and took advantage of the opportunities should have absolutely printed, while others were just buckled in for a bumpy ride.

We started the day with $SPY honestly looking alright, treading towards a new all-time high, opening the day at $696.42. Conditions were not the most optimal at open, but we did watch as there was mild bullish confusion at open, where we went on to make the official high of the day, trading at $697.05, and then watched as $SPY dove from the high ropes and everything plummeted early in the morning. We watched as silver dropped $14 per oz, and watched as $SPY went on and made the official low of the day at $684.83.

Conditions at the bottom were gross, but honestly, it was perfect as we alerted the perfect reversal at the bottom, and almost perfectly nailed our price target afterward. At the bottom, I wanted to watch as $SPY recovered back to $692, and that is exactly where the markets took us. $SPY recovered to $692, and then continued to remain relatively neutral around that price before starting to show mild bullish momentum leading into power hour.

Power hour started slow, trading in that $692 range, and we watched as $SPY moved up nicely in the back half of the trading day, where we ultimately watched as $SPY ended the day trading at $694.04, down $1.38 for the day, or down roughly 0.2%, despite the extremely volatile intraday movement. Not much happened on an overall basis, but man, oh man, did we watch as many individuals have a difficult time. Regardless of everything, though, that is simply just life and the markets.

Hopefully everyone was able to print on the opportunities presented to you, and if you did not… all you had to do was literally blindly follow me into any of my plays yesterday, and you would have absolutely printed. So, we just see where the markets take us this week, and hope for the best leading into the weekend!

S&P 500 Heat Map - 01/29/2026

Thoughts & Comments for Today - 01/30/2026

Today should be an interesting time for the overall markets, and I am excited to see what is going to happen. Silver and precious metals have started to fall heavily overnight, and part of me is kicking myself due to the insane price action we are seeing. Yesterday, I sold my put as I was up roughly 40% at the top. Now, $SLV is approximately $4 ITM from the initial alert provided. Doing the simple math, assuming anyone held their silver puts overnight from my entry, you should be up approximately 120% at this time.

Congrats to all of those silver bugs who printed on the way up. Congrats to all of the silver bears who shorted on the way down. And one massive congrats to anyone and everyone who realized some of their silver at the top!

As I have been saying before. I am not bearish on silver. I think that there is going to be extremely high demand for silver. I just believe that the price of silver is too high, and as a result of that, we will inevitably watch as many traders get shot attempting to FOMO into silver at the top, and that is what we are in the process of seeing right now. We are back below $100 an oz at the time of writing this report, and I believe that realistically, despite the demand for silver continuing to go up, it should continue to come down here in the short term.

Hopefully, no one realized a significant amount of losses on Silver, and absolutely printed though on our play, so continue to remain solvent, and make the most out of these opportunities that are being served to you on a silver platter!

Back to the general markets, though, I do believe that this is going to be an interesting time. I am expecting weakness in the general markets again today, but I am not sure if the weakness that is generated today will sustain itself. Be careful of a repeat of yesterday in the markets. In the case that it is, I am not expecting the movement to be that large or irrational, but at the same time, with the confusion and strength in the markets, anything can happen.

Going into today, I will say that market conditions do look weaker here in the short term, and I would be more comfortable actively shorting here than attempting to go long, but again, that is my short-term sentiment. I still do believe that these market conditions are strong. I still believe that opportunities will be presented to us to go long, but this is one of those cases where following the general momentum will be stronger, and traders will be more confident in the process.

So please tread lightly going into today, knowing that irrationality is amongst us, and many traders are going to have difficulties realizing gains consistently today, so be smart, be safe, and have some fun with the volatility in the markets.

Just make sure to practice safe risk management throughout today, and have an amazing time in the process. We will have some fun and go into this weekend strong!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $UNH, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/30/2026 (ET):

Producer Price Index (delayed report) - 8:30 AM

Notable Earnings for 01/30/2026:

Pre-Market Earnings:

SoFi (SOFI)

American Express (AXP)

Verizon Communications (VZ)

Canadian National Railway (CNI)

Charter Communications (CHTR)

Chevron Corporation (CVX)

XOM (XOM)

Colgate-Palmolive (CL)

Wrap up

This will be a quick and volatile day for the markets. Please make sure to practice safe risk management and to do everything in your power to realize some gains. Just remember that markets will be irrational, but that irrationality will provide us with opportunity. So be smart, be quick, and make the most out of these market conditions as traders can easily PRINT in the process!

Good luck trading, and let’s see where $SPY ends the week!