HaiKhuu Daily Report - 02/17/2026

Good morning, happy Tuesday, and happy new year!!! For those who do not know/are not celebrating, today is the Lunar New Year! I just want to say happy New Year to everyone and congratulate you all for surviving another year! May the year of the horse provide you all you have ever wished for and desired. May you and your family be happy, healthy, and wealthy during this year.

This is going to be a lot of fun with opportunities consistently presented to us, and now it is just a matter of making that a reality! Let’s absolutely kill it this year, and have an amazing time in the process!

Markets are down slightly at the time of writing this report, but markets are still looking strong overall. $SPY is testing that $680 magnet zone that we’ve been stuck in for a while, and we are seeing some weakness in crypto, which obviously is not the best sign going into a new week, but at the same time, hopefully the Chinese conspiracy theorists cause the markets to rally, and have an amazing time with significant realized gains.

It will be an interesting day for the markets, given how they're trending, so please just make sure you protect your bottom line and have an amazing time while attempting to allocate to the markets today! Let’s have some fun, realize some gains, and set this year up for prosperity!

ALSO - If you’ve not checked out the WEEKLY PREVIEW, please check it out to prepare for this week!

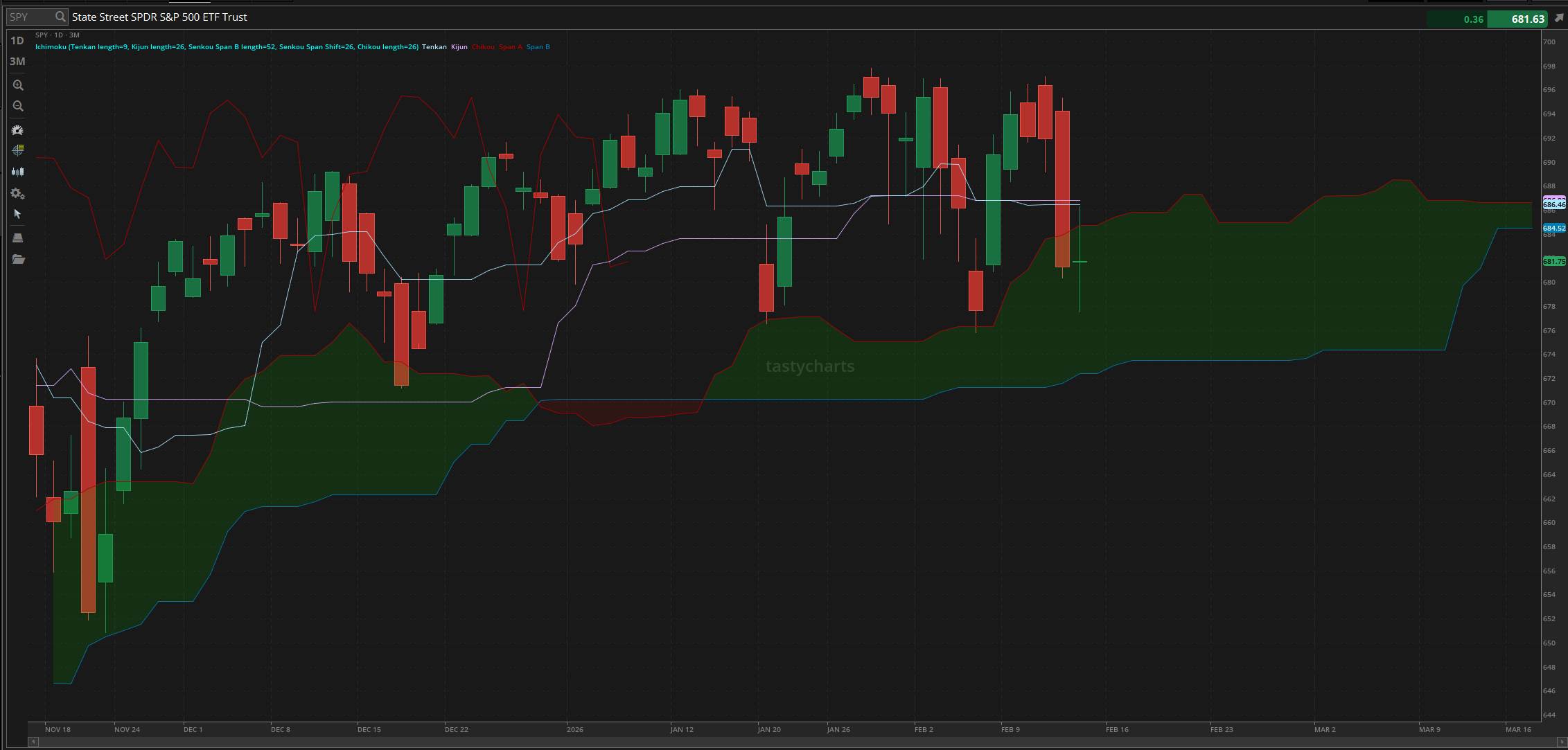

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $686.46

Baseline Resistance: $686.82

Psychological Support: $680

Daily Cloud Resistance: $684.73

Thoughts & Comments from Last Week

Last week was a relatively gross time for the markets with significant volatility, selling, and general bearish momentum. Opportunities were not amongst us like we hoped, but at the same time, it provided us with the solvency necessary to be able to realize a significant amount of gains. Those who were bearish, those who caught trends, and those who allocated properly had an absolutely amazing time, and I just want to say congrats again to anyone who followed us into some of those bearish allocations last week! We killed it multiple times over with puts on different organizations, netting over a 100% return on many of those plays, and had an absolutely amazing time in the process!

We started last week with $SPY hovering around $690, opening the week trading at $689.44. Market conditions looked alright from the get-go as we moved up quickly on Monday, and continued to look relatively bullish throughout the day. Conditions were looking great as $SPY rallied approximately $5, to gap up and look great leading into the bearish momentum on Tuesday, to gap up once again on Wednesday.

Wednesday was an alright day for the markets with a significant amount of volatility. We started the day with the highest open of the week, trading at $696.39, and watched as $SPY continued to tank throughout the entire day, displaying general weakness, and many traders had a genuinely unfortunate time. It was obviously not ideal having to attempt to trade at that time, but life and the markets continue to move on, as $SPY rejected the previous all-time high and watched as the markets came crashing down.

Thursday was an extremely bloody day for the markets as $SPY went from testing the previous all-time high, to coming right back down and hitting that $680 magnet zone. There was a $15 range on an intraday basis on Thursday, and many traders genuinely had a difficult time, but those who simply followed the market momentum, and those who were short on Thursday, absolutely killed it, before watching as Friday displayed one of the most neutral trading days of the entire year so far.

We started Friday with $SPY opening at $681.69. Conditions were looking sketchy, and we watched as $SPY dropped extremely quickly at open, making the official low of the day trading at $677.52, we grabbed some $678 OTM 0-DTE calls that absolutely ripped, and we timed the bottom almost perfectly. Conditions were great as $SPY rallied from the bottom, and watched as $SPY pushed about $9 from the bottom, to make the official high of the day, trading at $686.28. Conditions were great leading into the afternoon, and then we watched as $SPY sold off absolutely everything that was generated, and came back down to officially end the day trading at $681.75, creating almost a perfect $5 range in both directions, while closing neutral for the day.

The week officially ended down $8 overall, or down roughly 1.1%.

Again, I will not say that it was a great week for the markets, but opportunities were consistently amongst us during that time. Traders could have and should have realized some gains last week, and anyone who followed our sentiment in the markets should have had almost zero issues capitalizing on the bearish sentiment. So, let’s just see where the markets take us this week and realize some gains!

S&P 500 Heat Map - 02/13/2026

Thoughts & Comments for Today - 02/17/2026

Today is setting up to be a spicy and beautiful day for the general markets. With the confusion that traders are experiencing at this level, many traders are going to have an absolutely amazing time, while other traders, unfortunately, watch as they get burned. Please, just continue to tread lightly here at this $680 magnet zone and know that the volatility of these market conditions will continue to impact every here in the short term.

The one thing I am genuinely concerned about right now is that, given how technical analysis is setting up on a larger scale, we are starting to see the first signs of broader weakness. This could very easily be one major fake-out as the markets continue to move up, and that is obviously the hope, but with the way that things are setting up, it is hard for me not to bring up the realities and risks of allocating in these current market conditions. So please, tread lightly, practice safe risk management, and protect your bottom line.

The volatility and irrationality that we are experiencing in these conditions, though, are absolutely amazing for those who know how to capitalize on the trends or those who are attempting to capitalize on irrationality. Conditions can continue to remain confusing, but at the same time, with the way the markets are trending, it is almost hard not to be optimistic about where the markets can take us. It all just comes down to which direction you allocate and why.

As I’ve said before, it is unwise to attempt to fight the trend. If the markets are looking bullish, continue to remain bullish; if the markets are bearish, continue to remain bearish. Obviously, I only want the markets to trend up, but anything can happen, and we all have to just keep being realistic about both our plans to execute and our execution. So be smart, and allocate accordingly.

I still believe that higher beta single-name organizations are going to be the move while attempting to trade, but just know that $SPY is at a range where you can attempt to trade it again, so please, just make sure that you are capitalizing on these conditions when possible. Single names will have more intraday volatility and difficulty navigating, but will provide an exponentially more irrational day. But the irrationality and irregularity are what will make traders extremely profitable, so just keep that in mind.

Now, let’s talk conspiracy theories. Again, none of this is a signal to buy or sell anything, but me talking with a tinfoil hat about the new year, but in a traditional sense, it is never good to “lose” money on New Year's. This is a bad sign predicting how your year will go, and as a result of that, I do believe that there is a chance that we see a breakout in the markets as a result of Chinese people attempting to move the markets up today, to allow them the most opportunity possible while attempting to trade and realize some gains. Again, this is just a possible conspiracy theory on direction in the markets today, but it has happened previously, so it will be interesting to see how everything plays out.

I personally am not going to be trading as much today, and will be attempting to force as few trades as possible, and plan to stop trading as quickly as possible just for superstition on the day. Just wanna be profitable and call it a day!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX, $UNH, $AIFF

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 02/17/2026 (ET):

Empire State Manufacturing Survey - 8:30 AM

Notable Earnings for 02/17/2026:

Pre-Market Earnings:

Energy Transfer (ET)

Medtronic (MDT)

Leidos Holdings (LDOS)

Vulcan Materials Company (VMC)

CNH Global (CNH)

Allegion plc (ALLE)

Herc Holdings (HRI)

DTE Energy (DTE)

Geniune Parts Company (GPC)

After Market Earnings:

Palo Alto Networks (PANW)

Cadence Design Systems (CDNS)

EQT Corp (EQT)

Devon Energy N(DVN)

FirstEnergy (FE)

Kenvue (KVUE)

Toll Brothers (TOL)

Wrap up

Hopefully, this is a great day for the markets with opportunities consistently presented to us in the process. Many traders are going to be able to realize a significant amount of gains during this time, so just make sure to make the most out of today to set up the rest of your year for success! Good luck trading today, good luck trading this year, and may you, your friends, and your family all be happy, healthy, and prosperous this year!