HaiKhuu Daily Report - 01/28/2026

Good morning, and happy Wednesday! I hope you all are ready for the most volatile trading day of the week!

Markets are up BEAUTIFULLY at the moment, and assuming we see a continuation of strength, will continue to make all-time highs today. I am nervous because there are many catalysts coming up in the short term: we have FOMC later today, with Jerome Powell speaking, which will lead to volatility on an intraday basis, and we have major earnings from $MSFT, $META, and $TSLA after hours.

This is most likely the most volatile day of the week, and I hope you all are ready to PRINT today!

Buckle up, as anything can truly happen. I’ll talk more in depth about this later on in the full report, but please prepare accordingly for today.

We are at all-time highs right now. We can continue to make highs, but it all comes down to the back half of today to see where today takes us. Anyone trading before then should prepare for some irrationality and inconsistencies in the markets.

Regardless of anyone’s sentiment, this should be a beautiful day that provides us with significant realized gains, and we should all have an amazing time.

Tread lightly, and prepare for the irrationality of today!

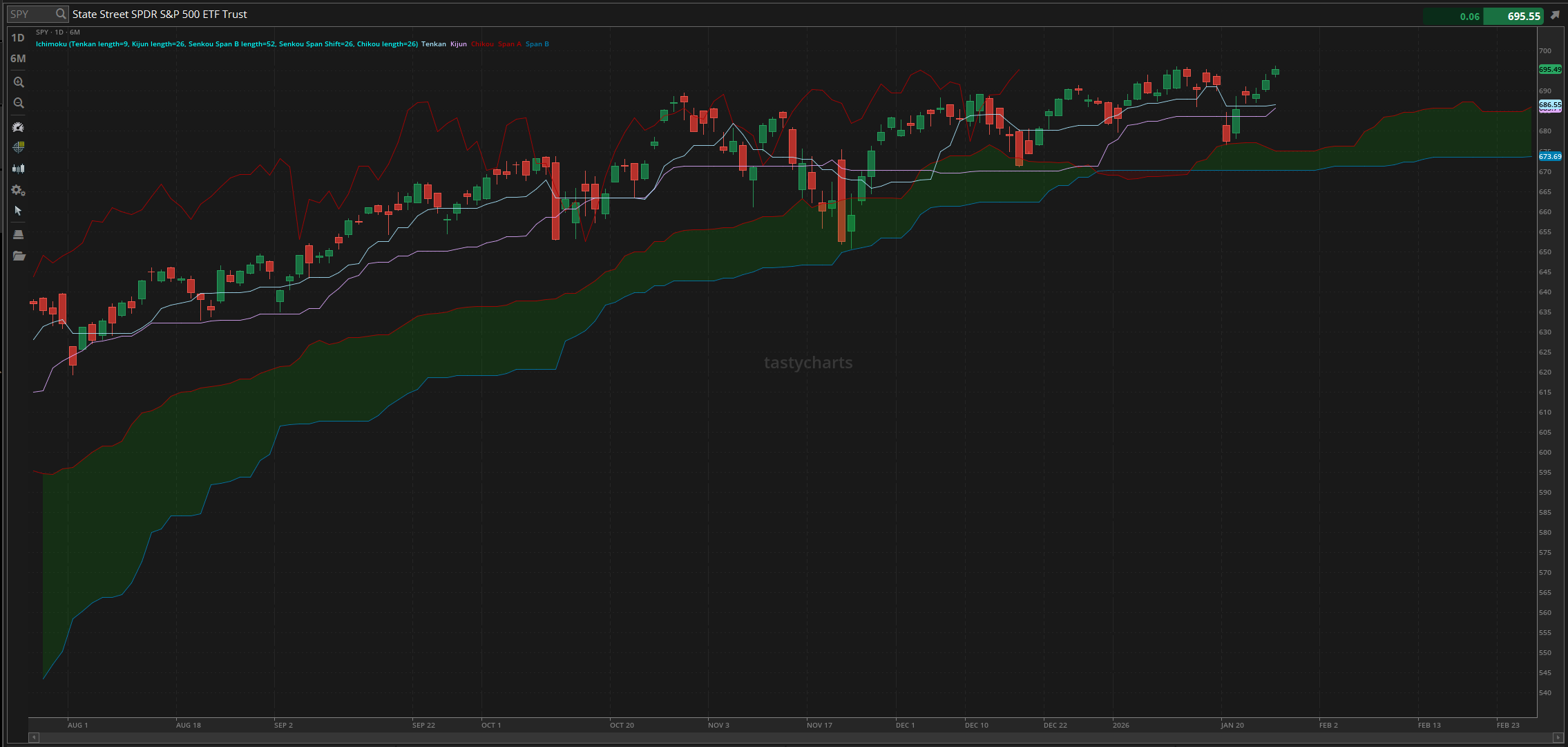

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.55

Baseline Support: $685.71

Psychological Support: $680

Psychological Resistance: $696.52

Daily Cloud Support: $675.16

Thoughts & Comments from Yesterday - 01/27/2026

Yesterday was a beautiful yet tough day for the markets that provided us all with opportunities to trade and generate a significant amount of realized gains. Markets were bullish and strong and went on to make a new all-time high, so I don’t know if anyone can complain about a situation like that. Hopefully, you all were able to ride the momentum and take advantage of the markets because man, oh man, was it a beautiful day!

We started the day with $SPY opening at $694.18, up about $1.50 from the previous close, and watched as there was mild confusion, and a weak bearish movement as $SPY went on and made the official low of the day at $693.57 early in the morning, before eding back up, and rallying nicely towards the previous all-time high, recovering absolutely everything that occured during that minor sell off, before slowly moving up again leading into the lunch time lull.

During the lull, $SPY went on to make the first of many all-time highs, and then we watched as $SPY made the official all-time high tradin at $696.52. Market conditions were great at the time, but as expected in these market conditions, after making the official high of the dayu and all-time high, we watched as we kissed the previous all-time high, and then came right back down.

Markets sold off in the early afternoon really remaining in an extremely tight range for the final five hours of the trading day, and honestly it was a complete snoozer despite absolutely flying by, so I hope you all were able to find opportunities to trade and realize some gains in the process as the markets continued to chug and do their thing.

We ended the day with $SPY trading at $695.49, up $2.76 for the day, or up roughly 0.4%. So, I will say it was a good day for the markets as we went on and made a new all-time high, but that was a tougher day for traders who attempted to scalp the back half of the day or were stuck watching as the markets unfortunately and inevitably chopped around. As long as you were not taking on dumb risk, then you would have been fine and had zero issues realizing some gains yesterday. Let’s see where the markets take us today, and have some fun!

S&P 500 Heat Map - 01/27/2026

Thoughts & Comments for Today - 01/28/2026

Today will be an interesting time for the markets. As I have said before, we all should be preparing for the most volatile day of this entire week. With FOMC coming out later today and many major earnings coming during the after-hours session, the rest of this week is going to be exceptionally irrational and inconsistent, but it will provide us all with some beautiful opportunities to trade and realize some gains!

Markets just made a new all-time high and are looking exceptionally confident leading into the day. This is a great sign for anyone who is bullish, has long general exposure, or is attempting to scalp and day trade today with confidence.

Please, make the most out of today as there is going to be a lot of volatility that makes trading irrational and more difficult, but at the same time, it should be interesting and provide us with an opportunity.

I will say this flat out today, after FOMC, anything can happen. The markets can rip, the markets can dive, and especially with earnings coming up after, allocations into the rest of the week are going to continue to remain irrational.

Either we break out, break past $700 on $SPY and continue to rally, or we are going to watch as the bears finally get their time and are right for the first time in however long, assuming that any bears still have solvency at this point.

So go into today with the hope that the markets continue to break out and rally from this point. It is optimistic to hope that it happens, but the reality of these market conditions is that we are strong and continuing to move up, and honestly, anyone who is attempting to fight the momentum today is either about to lose their ass again or be stuck in a position where they are continually getting burnt.

Just follow the trend, do not fight the new all-time high, and make fun of the bears who have kept fighting the strength in the markets here in the short term.

Okay, now let’s talk about FOMC. Leading into today, there is a 99% chance that rates remain unchanged, and as a result of that, traders should have generally no problems with that, as everyone is “unimpacted”, and the only way I see an irrational move happening is in the chance that there is a cut. There will be reassurance after the FOMC meeting, where nautrally assuming we do not get a cut, we should move up, but again, anything can happen. It all comes down to Jerome Powell and what he says during the meeting. If there is a random question that he drops the ball with, the markets have a chance to fall, but realistically, I am assuming it is typical FOMC trading, where there is both irrationality and FOMO in the markets.

The biggest fear that I realistically have at this point is not due to the irrationality that may come into the markets with FOMC, but my fear comes from the earnings after hours. We will see difficulties as there are earnings from $MSFT, $META, and $TSLA, meaning that pretty much every major tech sector is going to be heavily impacted as a result of this.

If $META has bad earnings, that will impact all other social media platforms as well as general tech here in the short term. If $MSFT has a tough time, that will heavily impact software & AI organizations, and if $TSLA has a hard time, that will heavily impact durable goods and the EV market. So, tread lightly knowing that FOMC today is going to be big, but the earnings that happen after hours today will be what really makes or breaks these market conditions.

Just make sure you do NOT fight the general market momentum, practice safe risk management, and allocate accordingly when there is confidence. This is gonna be a great day, so let’s have some fun and realize some gains!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/28/2026 (ET):

FOMC Interest-Rate Decision - 2:00 PM

Fed Chair Powell press conference - 2:30 PM

Notable Earnings for 01/28/2026:

Pre-Market Earnings:

GE Vernova (GEV)

ASML Holding (ASML)

AT&T Corp (T)

Amphenol (APH)

Corning (GLW)

General Dynamics (GD)

Starbucks (SBUX)

Automatic Data (ADP)

Danaher (DHR)

After Market Earnings:

Microsoft (MSFT)

Meta Platforms (META)

Tesla (TSLA)

Lam Research (LRCX)

ServiceNow (NOW)

International Business Machines (IBM)

WM (WM)

Celestica (CLS)

Wrap up

This is going to be a spicy day for the markets. There is volatility across the board, and the markets are going to move irrationally on both FOMC news and earnings after hours. We should be fine on an intraday basis, but just worry about what happens after the markets close today, because that will be the true test. Be smart, be safe, and make the most out of today!

Good luck trading, and let’s see where these earnings take us!