HaiKhuu Daily Report - 01/29/2026

Good morning and happy happy Thursday! Wow, I promised yesterday that we were going to see some volatility after hours, and man oh man did that work out almost perfectly! With $TSLA, $MSFT, and $META earnings happening after hours yesterday, we were provided with some insane opportunities to watch as the markets whipsawed around, and hopefully generated some gains and opportunities for some!

At the time of writing this report…

$TSLA is up slightly

$MSFT is down

and $META is the clear winner.

Markets are up, but conditions are skeptical as we are trending below the previous all-time high.

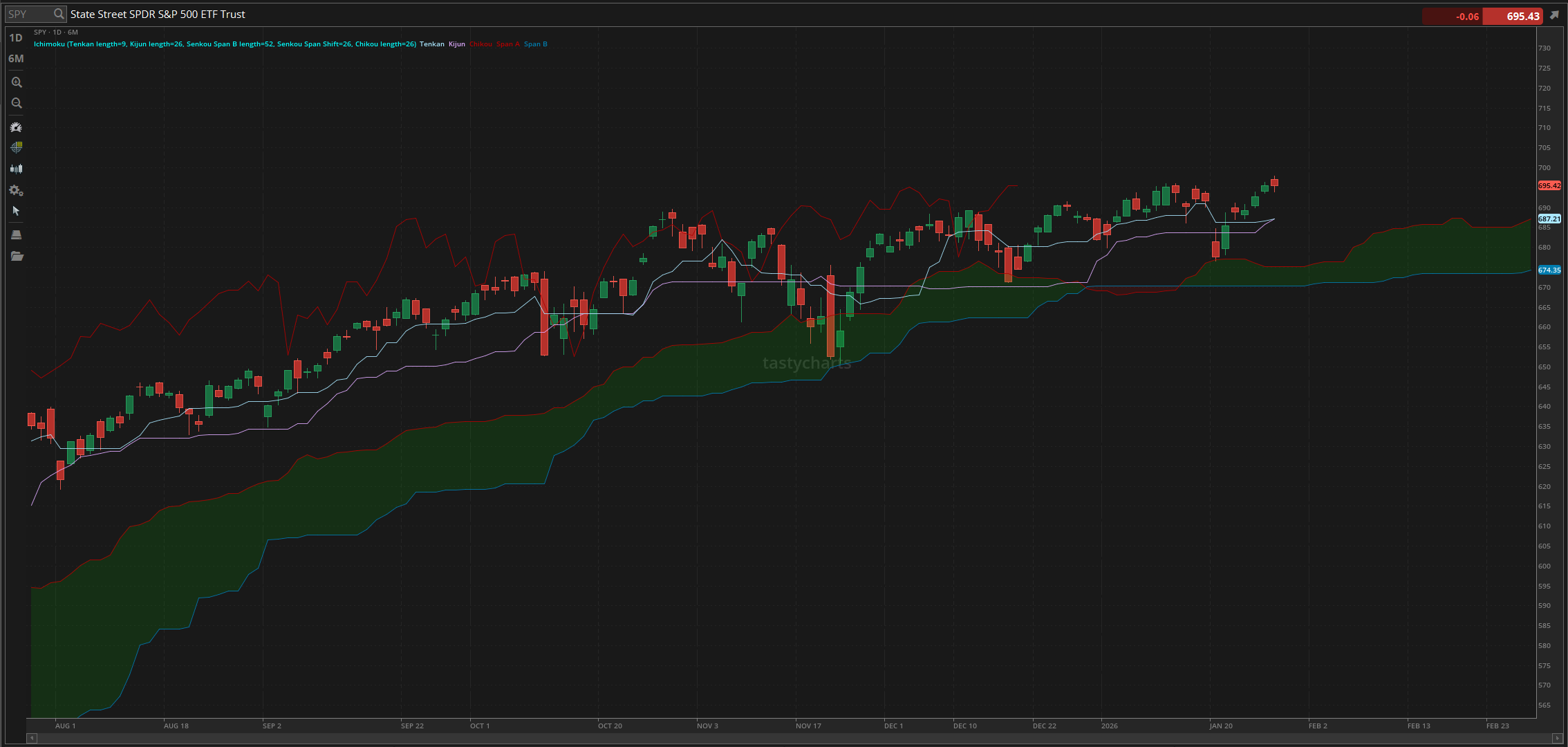

These conditions leading into today will be an interesting time, and hopefully, you all are ready for another confusing day. My biggest concern leading into the day is the fact that we continue to kiss new all-time highs on $SPY, without any definitive bullish momentum that causes us to continue our breakout at the scale necessary. $SPY $700 would be so much nicer than $SPY $697.

We are almost at that point of irrationality in the markets; now it is just a matter of making the most of these conditions and preparing accordingly for where the markets ultimately take us. I don’t see any reason why anyone is not presented with opportunities, but at the same time, just understand why losses will be generated. Just know that attempting to trade these market conditions is going to be difficult and inconsistent. So remain solvent, and make the most out of this irrationality!

Let’s have some fun today and see where this confusion takes us!

The updated $SPY daily levels are as follows:

Conversion Line Support: $687.21

Baseline Support: $687.15

Psychological Support: $680

Psychcological Resistance: $700

Daily Cloud Support: $675.14

Thoughts & Comments from Yesterday - 01/28/2026

Wow, so we expected volatility yesterday, and man, did the markets provide. We watched as $SPY went on and made a new all-time high, watched as Jerome Powell shut down some reporters, and watched as $SPY remained irrational throughout the entire day. Hopefully, you all were able to make the most out of the inconsistent conditions the markets provided to us, and hopefully you all were able to realize some gains! I know that the large majority of people who attempted to trade yesterday had a difficult time due to those inconsistencies, but as long as you minimized any losses, you should have had a great time!

We started the day with $SPY looking alright, opening the day at $697.10. We opened at a new all-time high, despite making an unofficial all-time high during the futures session, and watched as the markets remained confused with their sentiment from open. We continued to make new all-time highs going into the morning, making the official all-time high trading at $697.84, and then watched as $SPY reversed from the top, and showed weakness throughout the rest of the day.

$SPY sold off all the way until the lunchtime lull, where the markets continued to remain extremely neutral, and traders honestly were not provided with great opportunities to trade or realize gains with any sort of confidence. Markets remained neutral until FOMC, when the rates remained unchanged, the markets moved up slightly, before coming down and making the official low of the day, trading at $693.94, before Jerome Powell fixed the selling slightly, as $SPY recovered from the bottom, but remained extremely neutral into the end of the day.

Honestly, the final four hours of the trading day yesterday were a snooze fest as everyone waited for the after-hours session, as we knew major earnings were coming up, and officially ended the day with $SPY trading at $695.42, down $0.07 for the day, or down approximately 0.01%.

I’ve made notes about this before, and I will say it again, it’s tough when the markets go on and kiss a new all-time high ever so slightly, and come down, but that is always going to be a tough day for the markets because no one wants to play a game of lead the pack. Hopefully, we see an explosive breakout in the markets soon, but it comes down to how people attempt to allocate in these conditions. So let’s just see where the markets take us today, and hope there’s enough confidence to cause us to rally towards $700 on $SPY!

S&P 500 Heat Map - 01/28/2026

Thoughts & Comments for Today - 01/29/2026

Today will be a confusing time for the large majority of traders. With $SPY currently trending at new all-time highs, traders are going to be skeptical, and many are going to have issues with the ongoing market volatility. It would be great to be overly comfortable and confident in these market conditions, but traders are becoming more skeptical due to the short-term momentum we are experiencing. Markets on a larger scale are still extremely confident, but the question is, is there enough confidence to maintain the short-term weakness and confusion that we are experiencing at the moment, and what can we do to capitalize on these conditions?

Those are obviously going to be the questions that everyone asks, and honestly, with the irrationality in the markets at the moment, anything can truly happen, so everyone's predictions are just as valid as anyone else's.

Markets from this point can easily continue to break out and make a new all-time high, but all we need is a single catalyst to cause the markets to come down. There is not as many catalysts going into the markets today, but we are seeing weakness coming from traders right now as they lack confidence. There is $AAPL earnings after-hours today, but that is not going to heavily impact the intradaymomentum at this point.

If you are attempting to trade and allocate in these conditions, just be skeptical of the trend we’ve seen recently. Markets have been bullish and optimistic, but not strong enough to smash all-time highs. This has all become one major game of kiss a new all-time high, and smash all of the kids who are attempting to FOMO.

This is not necessarily a bad thing, but in reality, the weakness that we are seeing as a result of this movement is significant. Traders will see mild upside potential while they are attempting to trade into those all-time highs, but in the case that we kiss and come down like the markets did yesterday, then things get sketchy quickly due to a lack of general momentum resulting in over-trading, over-leveraging, and choppy neutrality. Many traders are going to have difficulties as a result of this, so if you are attempting to trade, tread lightly, as these conditions are going to be difficult to navigate.

In the case the markets break out again, be on the look out for $SPY $700, that will be the next major resistance level to watch, but in the case that the markets come down and start to sell off, know that we are seeing tightening on the daily support levels, and as a result of that, we are going to see support towards the downside both at $SPY $687 and $680.

Just tread lightly and be careful today. I am unsure where $AAPL is headed as they do have earnings after hours today, and it would be tough if they have a repeat of $MSFT, where they beat expectations yet underperform, so as a result, the markets quickly corrects. This would be difficult for many traders and create some bearish sentiment in the air. So tread lightly.

On a side note - I did start my $SLV short position. I have purchased Feb 20th, $90P’s on $SLV. I may be incorrect on this position, but I just want to put it on your radar that I have started to personally become mildly bearish on Silver, and I have started to encourage those who are in Silver to take profit. Again, I may be very wrong as silver continues to rip new all-time highs, but at the same time, it’s kind of the risk necessary for what I am looking for and attempting to watch in terms of a reversal. Again, do not blindly follow me. I may be wrong on the position, but I will see what happens and enjoy the process!

Just be smart, protect your bottom line, and realize some gains today.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/29/2026 (ET):

Initial Jobless Claims - 8:30 AM

Trade Deficit -(delayed report) - 8:30 AM

Productivity -(revised) - 8:30 AM

Wholesale Inventories - 10:00 AM

Factory Orders (delayed report) - 10:00 AM

Notable Earnings for 01/29/2026:

Pre-Market Earnings:

Mastercard (MA)

Caterpillar (CAT)

Nasdaq (NDAQ)

Nokia (NOK)

Royal Caribbean Cruises (RCL)

Lockheed Martin (LMT)

Southwest Airlines (LUV)

Tractor Supply (TSCO)

Honeywell (HON)

After Market Earnings:

Apple (AAPL)

SanDisk (SNDK)

Visa (V)

Hartford Financial (HIG)

SAP SE (SAP)

DXC (DXC)

LPL Financial Holdings (LPLA)

Wrap up

This will be an interesting time for the markets. We are in the leftovers phase of processing yesterday's earnings, markets are up slightly, and we have $AAPL and $SNDK earnings after hours today. This should be fun, with opportunities to actively trade, but it's all about capitalizing on these conditions, realizing some gains, and having a great time. Make some smart decisions and realize some gains!

Good luck trading, and let’s see where $SPY takes us today!